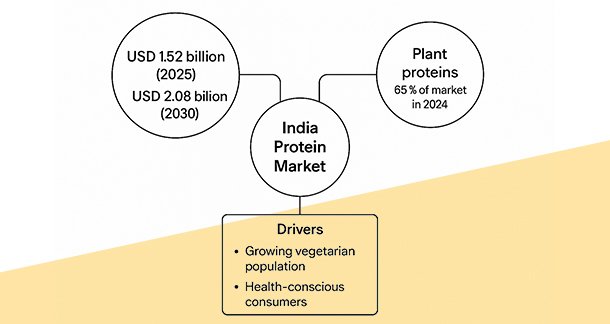

The India Protein Market is projected to grow from USD 1.52 billion in 2025 to USD 2.08 billion by 2030, at a CAGR of 6.52%. Plant proteins dominate, holding 65% of the market in 2024, driven by a growing vegetarian population and health-conscious consumers. Animal proteins, especially whey and collagen, are gaining traction due to increased fitness awareness and India’s leading milk production. The food and beverages sector leads with a 71% market share, while personal care and cosmetics are the fastest-growing segments. Government initiatives, such as Maharashtra’s support for soybean farmers, and technological advancements, like the Centre for Smart Protein in Bengaluru, are propelling market growth. Consumer preferences for sustainable and clean-label products are also influencing market dynamics.

India’s protein market is witnessing robust growth, primarily driven by rising health consciousness, changing dietary habits, and a growing fitness culture. The market is expected to grow from USD 1.52 billion in 2025 to USD 2.08 billion by 2030, reflecting a steady CAGR of 6.52%. This growth is underpinned by a shift in consumer preferences toward protein-rich diets, especially among urban and semi-urban populations.

Plant-based proteins lead the market, supported by India’s large vegetarian demographic and the increasing popularity of veganism. Products derived from soy, pea, and rice account for a significant market share, making up 65% in 2024. At the same time, animal-based proteins like whey and collagen are also gaining traction, especially among fitness enthusiasts, owing to the country’s strong dairy production and rising awareness of muscle and joint health benefits.

Consumers are increasingly seeking convenient, protein-enriched food options such as bars, shakes, and snacks that fit into fast-paced lifestyles. The growth of e-commerce has further facilitated access to a wide range of protein products, contributing to the expansion of the market across different regions. Areas like Delhi-NCR and states like Maharashtra and Gujarat are emerging as high-consumption zones due to their dense urban populations and developed health infrastructure.

In line with global wellness trends, Indian consumers are showing a preference for clean-label, sustainable, and flavored protein offerings. Additionally, government initiatives and technological innovations, such as the Centre for Smart Protein in Bengaluru, are playing a crucial role in shaping the future of the industry by encouraging sustainable protein production and supporting R&D efforts.

India’s whey protein market is poised for steady growth, with its value projected to rise from USD 92.03 million in 2023 to USD 125.2 million by 2030, reflecting a CAGR of approximately 5.08%. This expansion is driven by a youthful demographic increasingly focused on health and fitness, leading to heightened demand for nutritional supplements like whey protein. The proliferation of gyms, fitness centers, and sports facilities across the country has further fueled this trend, as trainers and nutritionists advocate for whey protein consumption to support muscle development and overall well-being. Endorsements by celebrities and athletes have also played a significant role in popularizing these products among the youth.

Whey protein is gaining prominence as a tool to combat obesity and protein deficiency in India. The nation’s shift towards sedentary lifestyles and increased consumption of high-calorie, low-nutrient foods has led to a rise in obesity rates. Additionally, the average daily protein intake among Indians falls below the recommended levels, primarily due to carbohydrate-rich diets. As awareness of these health issues grows, consumers are incorporating whey protein into their diets to aid in weight management and meet nutritional needs.

However, the market faces challenges from the proliferation of counterfeit whey protein products, which can erode consumer trust. These fake products often contain inaccurate protein content and harmful substances, posing health risks. Ensuring product authenticity and quality is crucial to maintaining consumer confidence and sustaining market growth.

Sports nutrition remains the dominant application segment for whey protein in India, driven by its use among athletes and fitness enthusiasts to enhance performance and muscle mass. The country’s hosting of major sporting events, such as the Youth Olympics and the Olympics in the coming years, is expected to further boost demand. Recent product launches, like Naturell India’s Max Protein Whey and Explosive Whey’s athlete-standard whey protein, indicate a vibrant and competitive market landscape.

India’s insect protein market is emerging as a sustainable solution to the growing demand for animal feed, driven by the increasing consumption of meat and the overexploitation of marine resources. Traditional sources like fishmeal are becoming unsustainable, with India utilizing approximately 600,000 to 700,000 tons of wild-caught fish annually for feed production. This has led to the exploration of alternative protein sources, such as insect-based proteins, which offer a more environmentally friendly and efficient option.

Black Soldier Fly (BSF) larvae thrive in India’s warm climate, especially in the south, making them a cost-effective option for insect farming compared to colder regions that need added heating. However, production costs are rising due to competition for substrates like brewers’ spent grain and palm kernel expeller, making BSF protein significantly pricier than fishmeal. To stay competitive, companies must offer added benefits such as enhanced growth, immunity, and feed efficiency. Building credibility through scientific trials and trusted partnerships is vital for farmer adoption. With limited alternatives like silkworm pupae, BSF’s success is key to advancing sustainable animal nutrition in India.

About the Author

By Venkatesh Ganapathy

The author is a faculty member with Great Learning.com. He has written extensively on food and beverages since 2012.