India, with its deep agricultural roots and rapidly evolving food ecosystem, is poised to play a pivotal role in shaping the future of alternative meat, not only domestically but globally. As sustainability, animal welfare, and health consciousness gain prominence, the demand for plant-based and cultivated meat alternatives is rapidly accelerating. India, with its unique blend of crop biodiversity, growing health awareness, and cost advantages, is perfectly positioned to become a global leader in this movement.

Agricultural Diversity: The Bedrock of India’s Alternative Meat Industry

India’s agrarian heritage offers a fertile foundation for alternative meat innovation. As one of the world’s top producers of protein-rich crops such as chickpeas, lentils, soybeans, millets, and peas, the country enjoys access to an abundant, cost-effective, and sustainable raw material base. With 45,000 plant species and leading global rankings in the production of essential crops, India is naturally equipped to support plant-based protein innovation.

Millets, in particular, present a promising alternative protein source. These climate-resilient, nutrient-dense grains, such as sorghum, pearl millet, foxtail millet, and finger millet—thrive in arid conditions and require minimal water, making them an ecologically sound choice for meat substitutes. Their adaptability and high fiber content make them ideal ingredients for formulating healthier and more sustainable meat alternatives.

The Rise of Alternative Meat Startups in India

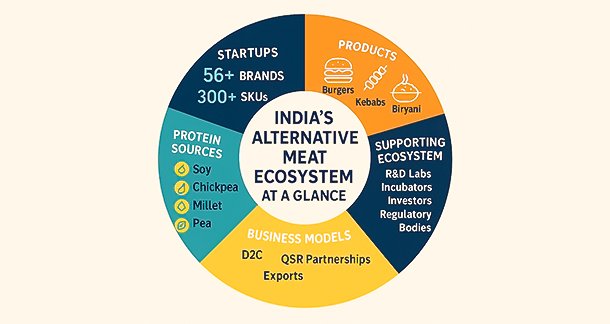

The alternative meat sector in India has seen unprecedented growth in recent years. Over 56 companies have launched plant-based meat products across more than 300 stock keeping units (SKUs), spanning various formats such as burgers, kebabs, sausages, biryanis, and even regional delicacies. Many of these innovations use indigenous crops and are enhanced with traditional Indian spices to appeal to local palates.

Startups innovating and replicating the texture, flavor, and mouthfeel of meat, satisfying consumer cravings without compromising on ethics or environmental responsibility.

Beyond plant-based formulations, India is also witnessing early-stage activity in precision fermentation and cultivated meat. At least ten Indian companies are delving into deep-tech innovations, developing fermentation-derived proteins and lab-grown meat to build a future where meat doesn’t have to come from animals.

Market Drivers Fueling Growth

Several key factors are contributing to the rapid expansion of alternative meat in India:

- Health-Conscious Consumers: A growing section of Indian consumers is opting for low-cholesterol, high-fiber diets. This trend aligns perfectly with the nutritional profile of plant-based meats.

- Large Vegetarian Base: India’s sizable vegetarian population presents a ready market for meat alternatives, especially products that mimic meat for flexitarians or vegetarians seeking more variety.

- Food Service Demand: Restaurants and quick-service chains are increasingly offering plant-based meat options to cater to vegan and health-conscious diners, driving mainstream visibility.

- Export Potential: India’s proximity to large vegetarian and flexitarian populations in South Asia, the Middle East, and parts of Africa creates a lucrative export opportunity for alternative meat products.

According to a joint report by GFI India and Deloitte, India’s plant-based meat export potential could range from ₹2,194 crore to ₹6,824 crore by 2030, making it a compelling market for global and domestic investors alike.

Funding and Infrastructure: The Road Ahead

While the sector holds immense promise, there are critical gaps in infrastructure and funding that need to be addressed. Unlike conventional food processing, the alternative meat industry requires specialized facilities for pilot-scale experimentation, formulation testing, and large-scale production.

Venture capital is beginning to take notice. Ahimsa VC, India’s first dedicated fund focused on reducing harm to the planet, animals, and human health, is championing early-stage alternative protein startups. However, the flow of capital still lags behind markets like the U.S., China, and Israel. In 2021, India attracted only $10.35 million of the global $5 billion investment in alternative protein—underscoring the urgent need for policy and financial support.

Schemes like the Pradhan Mantri Kisan Sampada Yojana (PMKSY), the Production Linked Incentive Scheme for Food Processing (PLISFPI), and NABARD’s Food Processing Fund are steps in the right direction. These initiatives provide affordable credit, support food parks, and incentivize innovation, helping entrepreneurs scale their ideas.

Building the Future of Meat in India

To truly unlock the potential of India’s alternative meat sector, a multi-pronged strategy is essential. This includes:

- Encouraging collaboration between research institutions and food startups to develop innovative meat analogues.

- Enhancing regulatory clarity and creating standards for alternative meat products to build consumer trust and facilitate exports.

- Investing in R&D infrastructure to lower production costs and improve product quality.

- Facilitating access to “patient capital” that supports long-term innovation, especially in areas like fermentation and cultivated meat.

Conclusion

India’s alternative meat sector stands at a historic inflection point. With its rich agricultural base, emerging entrepreneurial ecosystem, and rising domestic demand, the country has all the right ingredients to lead the global shift toward sustainable meat alternatives. What’s needed now is a coordinated push from government, investors, and innovators to scale smart protein solutions that are good for people, the planet, and future generations.

Submitted by:

Anjali Lokare

Author’s Bio:

Anjali Lokare, a Pune-based Food Consultant with an MSc in Nutrition and Food Processing, currently works with Farm To Fork Solutions, CASMB, FoodTech Pathshala and serves on the Editorial Board of Purnabramha Magazine. Certified in food safety and ISO 22000:2018 & Lead Auditor: Global standard for Food Safety Issue 9- BRCGS.